FirstEnergy Corporation’s FE expanding regulated base and improving transmission lines are likely to boost its earnings. Also, FE’s efforts to reduce emission levels are expected to be beneficial in the future.

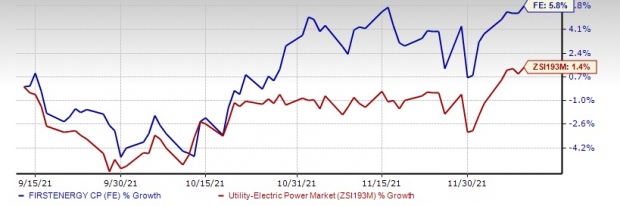

The Zacks Consensus Estimate for 2021 earnings is pegged at $2.60 per share, indicating growth of 8.8% from the year-ago reported figure. Also, the consensus mark for current-year revenues stands at $11.12 billion, suggesting 3.1% growth from the prior-year reported number. In the past three months, shares of this presently Zacks Rank #3 (Hold) player have gained 5.8%, outperforming the industry’s rise of 1.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

– Zacks

– Zacks

Three Months Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

What’s Driving the Stock?

FirstEnergy’s efforts to extend its regulated generation mix lent consistency to its long-term earnings. FE’s transmission and distribution operations are spread across 65,000 square miles in six states and its rate structure provides stability during an economic crisis. Its investment in strengthening the transmission and distribution lines will enable it to serve its six million customers more efficiently. It expects investment worth up to $2.9 billion in reinforcing its transmission and distribution network during 2021.

Owing to an improving economy, demand from the commercial and industrial group rose in the September quarter but due to weather, demand from the residential players (who account for nearly 65% of FE’s distribution revenues) dipped. Nonetheless, significant dependence on its residential customers will likely strengthen its prospects in any difficult period.

FirstEnergy is focused on lowering its emission levels and took initiatives to that end. In November 2020, FE revised its target to become net carbon neutral by 2050. Other electric utilities also adopting measures to supply clean and reliable energy to their customers include Duke Energy DUK, Xcel Energy XEL and Alliant Energy LNT. While XELcarries a Zacks Rank#3 at present, LNT and DUK hold a Zacks Rank#2 (Buy). All three stocks are planning to provide absolute clean energy by 2050.

The long-term (three-five) earnings growth rate for DUK, XEL and LNT is pegged at 5.3%, 6.4% and 6.1% each. The dividend yield of Duke Energy, Xcel Energy and Alliant Energy is 3.9%, 2.8% and 2.7%, respectively. Earnings surprise delivered by DUK, XEL and LNT in the last four quarters is 2.3%, 2.1% and 4.4% each, on average. The Zacks Consensus Estimate for 2022 earnings of Duke Energy has moved 0.2% up in the past 60 days while that of Xcel Energy and Alliant Energy has remained stable.

Woes

On the flip side, FirstEnergy still possesses coal-fired generating plants that are required to comply with the federal, state and local environmental statutes, thereby elevating its costs. Thus, a likely escalation in the compliance costs may affect the profitability. The risks involved in unplanned outages and an unexpected delay in completing the ongoing project remain headwinds.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Alliant Energy Corporation (LNT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research