Electronics manufacturing services and solutions provider Jabil Circuit (NYSE: JBL) stock has been on a year since its pandemic bottom formed in March 2020.

Free Book Preview

Money-Smart Solopreneur

This book gives you the essential guide for easy-to-follow tips and strategies to create more financial success.

4 min read

This story originally appeared on MarketBeat

Electronics manufacturing services and solutions provider Jabil Circuit (NYSE: JBL) stock has been on a year since its pandemic bottom formed in March 2020. The explosion in consumer electronics and device usage has been a key growth driver, especially with consumers adopting work-learn-engage at home trends. The maker of electronic circuit boards is a key component provider and supplier to major brands including Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), Hewlett Packard (NYSE: HP), Johnson & Johnson (NYSE: JNJ), and Tesla (NASDAQ: TSLA). The Company is set to gain on the growth in electronics powered by digital transformation and 5G adoption, constrained by global chip shortage of 2021. The re-openings are being accelerated from COVID vaccinations. Prudent investors looking to capture gains from the momentum in secular growth trends in healthcare, automotive and 5G adoption can monitor shares of Jabil Circuit for opportunistic pullbacks.

Q2 Fiscal 2021 Earnings Release

On March 16, 2021, Jabil reported its Q2 fiscal 2021 results for the quarter ending February 2021. The Company reported earnings-per-share (EPS) of $1.27 versus consensus analyst estimates for $0.82, a $0.45 beat. Revenues grew 11.5% year-over-year (YoY) to $6.83 billion, beating analyst estimates for $6.39 billion. Diversified Manufacturing Services (DMS) revenues grew 26% while Electronics Manufacturing Services (EMS) revenues fell (-1%) YoY. The Company generated $20 million in Q2 and capex, net of customer co-investments, of $152 million. Global credit facilities totaled $3.8 billion for total available liquidity of $4.6 billion. The Company bought back 1.9 million shares at a cost of $82 million and still has $254 million remaining under the buyback authorization expected to be completed by 2H 2021.

Jabil Raises Forecasts

The Company raised its Q3 EPS guidance to a range of $0.90 to $1.00 versus $0.87 analyst estimates. Revenues are expected to come in between $6.6 billion to $7.2 billion compared to $6.33 billion consensus analyst estimates. Jabil raised full-year fiscal 2021 EPS guidance to $5.00 versus $3.94 analyst estimates and revenue guidance to $28.5 billion versus $26.98 billion analyst estimates.

Conference Call Takeaways

Jabil CEO Mark Mondello set the tone, “Today, our business is wide-ranging and resilient; this is especially true when any individual product or product family is faced with a macro disruption of cyclical demand. Furthermore, our current business mix provides a unique set of capabilities, innovative capabilities openly shared across the enterprise with speed and precision as we simplify the complex for our customers. It’s a proven formula that’s trusted by many of the world’s most remarkable companies.” CEO Mondello went on to point out the efforts of the past several years have enabled the Company to expand its industry segment base and align with secular trends including 5G, personalized healthcare, digital learning, electric vehicles, cloud computing, clean energy, and eco-friendly packaging.

Secular Trends Driving Growth

Jabil CFO Mike Dastoor summed up the long-term secular trends that will drive growth for many years to come. In healthcare, companies are shifting from manufacturing to connected product solutions. In the automotive industry, electric vehicles are a major driver making up only 2% of total vehicles currently, “Climate change, fuel efficiency, and emissions are ongoing concerns and regulatory policies worldwide are beginning to mandate more eco-friendly technologies.” The adoption of 5G is accelerating, “5G will transform the way we live, work, play and educate. As the underlying infrastructure continues to roll out.” This also contributes to further migration and expansion of the cloud, “This, coupled with the value proposition Jabil offers to cloud hyperscalers, is helping up grow market shares in an expanding market, evidenced by the significant growth over the last three years.”

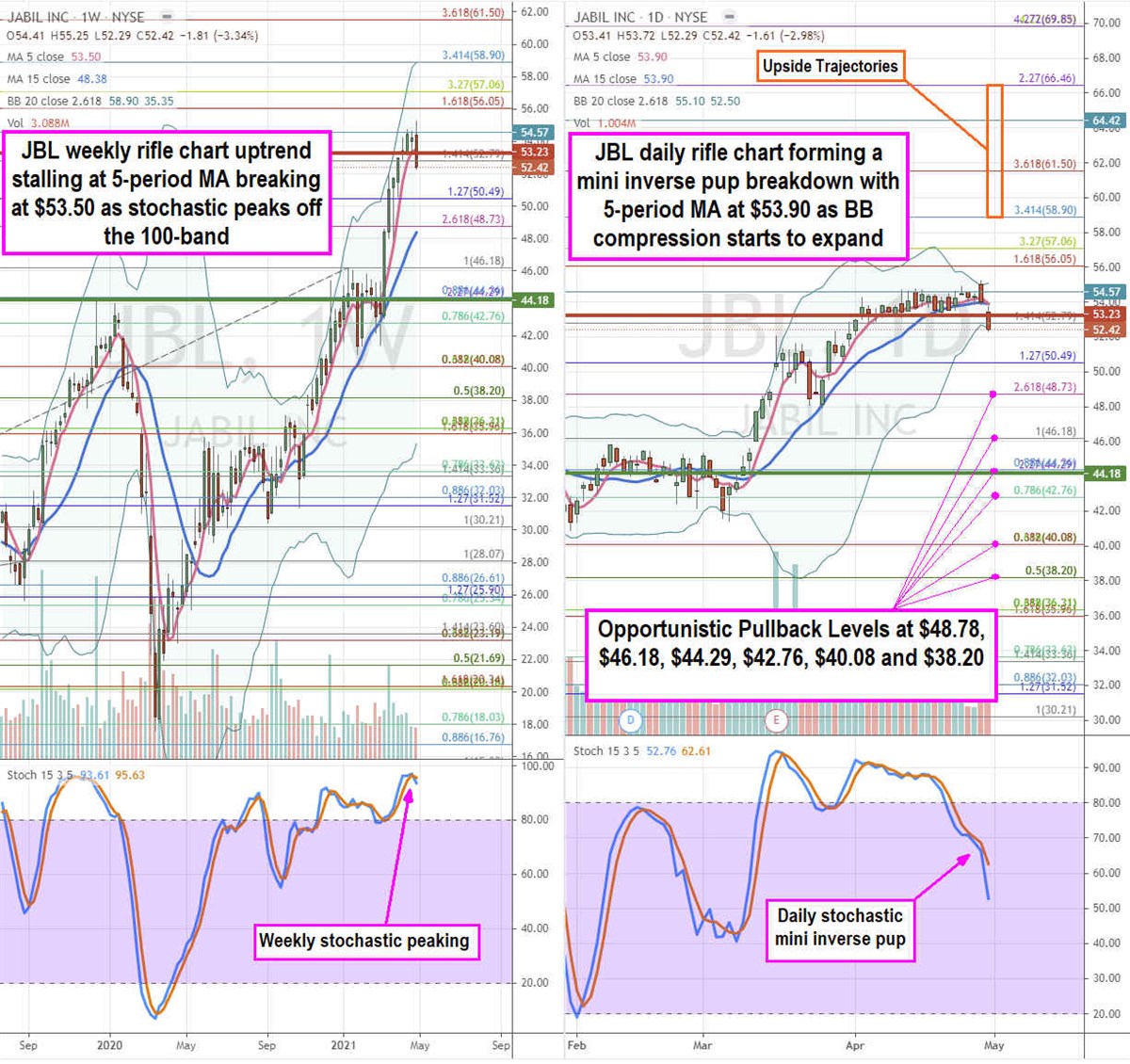

JBL Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for JBL stock. The weekly rifle chart uptrend peaked out below the $56.05 Fibonacci (fib) level. Shares fell under the 5-period moving average (MA) support at $53.50 as the weekly stochastic peaked near the 100-band and cross down. The weekly 15-period MA sits near the $48.73 fib. The daily stochastic formed a stochastic mini inverse pup on the market structure high (MSH) trigger break under $53.23. The daily market structure low (MSL) buy triggered on the $44.18 breakout in March 2021. The daily Bollinger Bands (BBs) have been contracting but are now starting to expand which signaling a larger price range is forming likely in lower. This can provide opportunistic pullback levels at the $48.78 fib, $46.18 fib, $44.29 fib, $42.76 fib, $40.08 fib, and the $38.20 fib. Upside trajectories range from the $58.90 fib up towards the $66.46 fib level. Keep an eye on peer stocks SANM and CLS as they tend move together as a group.

Featured Article: Cost of Capital Explained