The battle of Twitter vs. Elon Musk wages onward following the billionaire’s bid to purchase the company for $43 billion last week.

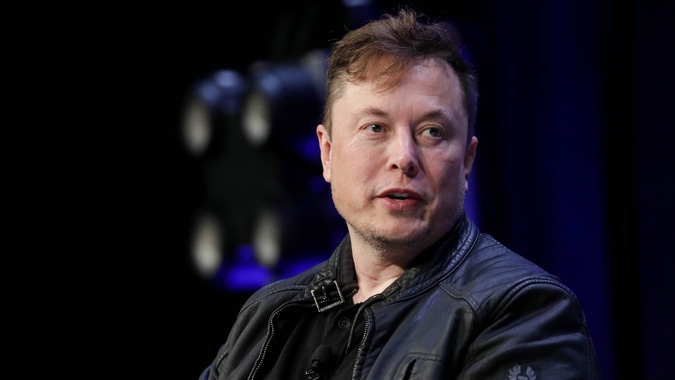

Anadolu Agency | Getty Images

Twitter employees and shareholders have reportedly been stressed and disgruntled since Musk acquired nearly 10% of the company’s shares, fearing internal change and shifts that they aren’t exactly on board with.

Musk’s latest proclamation via the social media platform is direct proof of that.

On Monday, Musk responded to a Tweet from Gary Black, a managing partner at Future Fund, and pointed out that if Twitter were to become a private company under Musk’s ownership, members of the board would no longer be paid.

Currently they are paid between $250,000 to $300,000 annually, which totals around $3 million per year.

Related: Elon Musk Will No Longer Join Twitter Board

“The board serves to represent shareholders,” Black wrote. “If they refuse to act in the best interest of SHs, they should be removed and replaced by new board members who understand their fiduciary obligations.”

Musk replied and added to Black’s statement.

“Board salary will be $0 if my bid succeeds, so that’s ~$3M/year saved right there,” the Tesla CEO wrote.

Board salary will be $0 if my bid succeeds, so that’s ~$3M/year saved right there

— Elon Musk (@elonmusk) April 18, 2022

This follows Musk’s response to a Tweet over the weekend in which he claimed that the “economic interests” of the Twitter board “are simply not aligned with shareholders” by pointing out that members of the Twitter board own minimal company shares.

Musk is still the largest individual shareholder of Twitter, though investment firm Vanguard is now the overall largest shareholder of the company, owning about 10.3% of Twitter shares.

The billionaire was asked to join the Twitter board before declining on what would have been his official first day, April 9.

“Elon shared that same morning that he will no longer be joining the Board. I believe this is for the best,” Twitter CEO Parag Agrawal said at the time. “We have and always will value input from our shareholders whether they are on our Board or not. Elon is our biggest shareholder and we will remain open to his input.”

Last week, Musk proposed taking Twitter private at $54.20 per share in cash, a 54% premium from the day before he began buying Twitter stock.

However, Musk’s proposition is likely to be blocked by shareholders who are not keen on his takeover.

CNBC has also reported that private equity firm Apollo Global Management has been in talks to buy Twitter before Musk does in what would be a “preferred equity” type plan, though the firm has not publicly commented on or confirmed the rumors.

Twitter was down just shy of 30% as of Tuesday afternoon.

Exclusive: Tom Brady Appoints Lowe’s Executive as the New CEO of His Wellness Company TB12

The Richest Person on Earth Breaks Every Rule, and You Should Too

Food Network Star Geoffrey Zakarian Distills the Entire Hospitality Industry Down Into Just 48 Words

Overcome the 5 Common Obstacles Keeping You From Full-Time Entrepreneurship

How This First-Generation American Founder Is Taking on Fast-Food Giants

Want to Improve Your Creativity and Focus? Try Eating Chocolate for Breakfast

How the Creator of Dugout Mugs Hit a $30 Million Home Run With a Business He Started in His Apartment